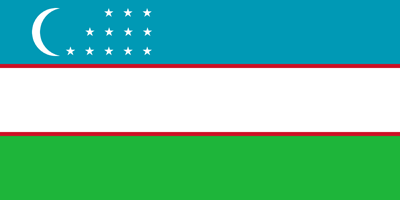

BwB partners with UNDP to issue first SDG bond for Uzbekistan

- bwbukltd

- Sep 2, 2021

- 3 min read

London, UK, September 2nd, 2021—During July 2021, the Ministry of Finance of Uzbekistan, in partnership with Bankers without Boundaries (BwB) and UNDP, issued the placement of a sustainable Eurobond on the London Stock Exchange. The Uzbek Ministry of Finance placed a dual-tranche sovereign Eurobond denominated in both U.S. dollars and Uzbek sums totaling US$ 870 million on the London Stock Exchange. The issuance saw strong investor demand and the offer was oversubscribed. The initial coupon is 14%.

BwB believes the success of sovereign SDG bonds can help other countries deal with the covid-19 pandemic and allowing us to build back better. Alexander Wiese and Chris Smith, Co-Heads EMEA and managing directors at Bankers without Boundaries, commented, “The new issuance of Uzbekistan’s sovereign international bonds has already attracted interest of approximately 50 international investors from the United States, United Kingdom, Germany, Luxembourg, Switzerland, Denmark, Singapore and the United Arab Emirates. This level of interest from international investors is a strong measure of support for the country’s focus on fiscal and monetary policy and plans for sustainable development, social protection and green economy.”

BwB helped develop the sustainability framework that highlights what can be considered eligible SDG expenditures relating to the objectives of Uzbekistan and the SDG goals. For example, construction, reconstruction or maintenance of public schools or libraries will provide affordable, equitable and quality education to improve literacy and numeracy.

BwB will also conduct, in partnership with the Ministry of Finance, capacity building workshops with key Government Ministries to demonstrate how funds can be spent and how to track the progress of the issuance. BwB will help develop key performance metrics and a reporting framework to ensure compliance with the framework for investors.

Comments